CMC Markets Review

August 17, 2017IG Markets Review

August 17, 2017FP Markets Review – 2023

FP Markets is an Australian-owned & operated CFD & FX provider with 15 years’ industry experience. They have won a large number of awards (35 to be precise..) for their customer service, fast execution and client satisfaction.

Since launching in 2005, FP Markets has grown to become a relatively well-known broker within the CFD space. FP have a very competitive offering – a wide variety of products to trade, multiple trading platforms, low spreads and high-quality support. Find out more by reading our FP Markets review below.

FP Markets offer a vast range of products to trade, including;

- CFD Trading: Access over 10,000 CFD products across Shares, Indices, Commodities (including metals), Cryptocurrencies and Futures

- Forex: Trade 50+ FX currency pairs including all the majors (AUD/USD, EUR/USD, GBP/USD, USD/JPY) and other, minor FX pairs (AUD/SGD, NZD/CHF, USD/NOK)

- Share Trading: Look to trade 2000+ Australian stocks & ETFs.

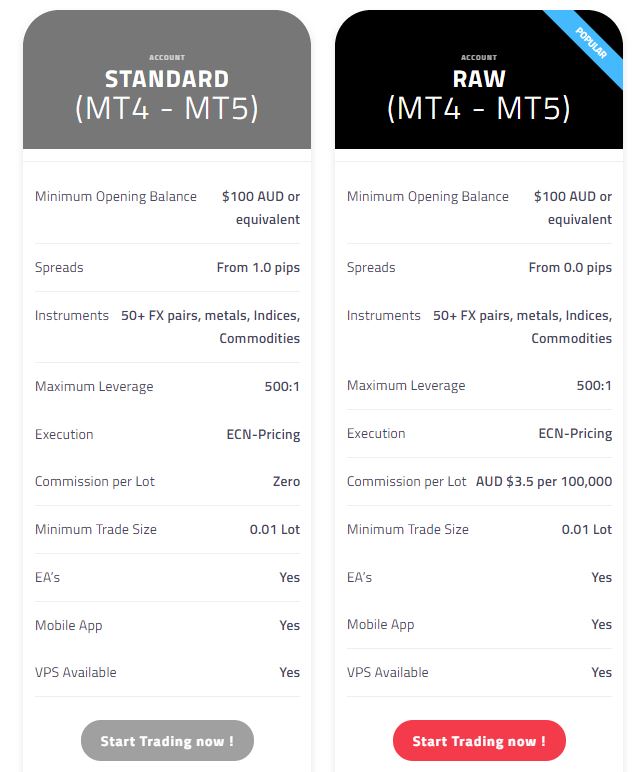

FP Markets has several different account types and which one you choose will depend on whether you wish to trade CFDs or FX (or both), your level of experience and size of account. Find out more below.

Professional: the pro account provides access to competitive commissions and rates of margin. Minimum opening deposit needs to be at least $100, brokerage is a minimum $10 charge, financing is RBA +4.0%, IRESS trader & fee is $55 inc. GST and the fee is waived if you generate $150 in comm/month.

Platinum: the platinum account provides lower commission and financing charges than the pro account. Minimum opening balance is $25,000, brokerage rate is $9 min, financing is RBA +3.5%, IRESS trader & fee is $55. ASX live data fee is $22 and the fee is waived if you generate $50 in comm/month.

Premier: the premier account is for professional traders only. The minimum deposit starts at $50,000, there are no minimums on brokerage fees, financing is RBA +3%, IRESS platform fees are waived, IRESS Investor & Fee is free, ASX Live Data fee is waived and premier clients receive tighter spreads.

Offering fair and transparent pricing for all clients, FP Markets is probably one of Australia’s best value DMA brokers. With no dealer intervention and bid/offer quotes coming from major financial institutions, FP Markets has the ability to offer tight spreads and low (or no) commission charges.

Spreads

FP offers DMA trading with variable spreads;

- Forex: FP Markets offers a Standard FX account and a Raw ECN account. The Raw ECN account offers the tightest spreads with EUR/USD starting at 0.0 pips, AUD/USD 0.1 pips and USD/JPY starting at 0.2 pips, however the Standard account comes with $0 commission trading, while there is a AUD $3.50 commission for the Raw ECN account.

- Indices: trade the Aussie 200 index, the DAX and the UK100 starting at a 1pt spread. Wall St is quite wide, starting at a minimum 4pt spread.

- Commodities: trade Gold (6 points), Silver (8 points) and Crude Oil (5 points), plus a few other commodities.There is no added commission on commodity trades.

Commission

Only FX traders using FP Markets’ Raw ECN account will incur a commission charge (of AUD $3.50 per leg/ per lot). Traders using their Standard Account will not be charged commission.

Leverage

FP Markets offer standard leverage of 100:1 on accounts, however the maximum leverage available is a staggering 500:1.

Trading platforms

Choose between three excellent trading platforms; WebIRESS, MT4 and MT5. More on these platforms below

Funding options

You can fund your FP account in a number of ways; credit or debit cards, China Union Pay, PayPal, Skrill, PoliPay, Fasapay, Paytrust88, Ngan Luong, Online Pay, Bank wire (swift), Bpay and Neteller.

Licenced and regulated

FP Markets holds an Australian Financial Services Licence (ASFL No. 286354) and is regulated by ASIC (the Australian Securities & Investment Commission). FP is also regulated by CySEC.

Security of funds

All client funds are held in segregated accounts with the Commonwealth Bank (CBA), one of the big four banks in Australia and a Tier 1 AA-rated bank. These funds are not used for hedging purposes.

Award-winning education material

FP have an extensive range of award-winning, education material for all traders – beginner, intermediate and advanced. You can download eBooks, platform guides and video tutorials, and also subscribe to daily market reports, webinars, an economic calendar, news-feeds and other free reports.

CFD pricing

As FP Markets offer DMA access on their CFDs, you may incur a slightly higher commission cost at times. This is the small price you pay for direct market access though so not entirely bad news.

FP Markets offers its clients a choice of the WebIRESS platform or the MT4 and MT5 trading platforms. They are one of a very select number of brokers who have never built their own proprietary trading platform.

WebIRESS: FP is the longest running WebIRESS broker in Australia and their WebIRESS platform offers access to a wide-range of international markets, transparent pricing & market depth, live news & pricing, advanced charting and complex order types.

MT4: their MT4 platform has been designed to provide a ECN trading environment with all the features; real-time quoting, advanced charting, one-click trading, algorithmic trading (EA’s), detailed news & insights, fast execution, plus more. Gain access of 500:1 leverage and spreads start from 0.0 pips.

MT5: FP now offers the ‘all-in-one’ MT5 platform for trading FX, indices, shares and commodities. Access 60+ trading instruments, leverage of 500:1 and spreads starting from 0.0 pips.