Simplified Guide to Social Trading

September 26, 2018Compare the Best ECN Brokers

April 30, 2019 eToro Review – The World’s Leading Social Trading Platform

eToro Review – The World’s Leading Social Trading Platform

Since launching in 2007, eToro has led the social trading revolution. Today it is the most popular social trading network, with millions of users scattered all around the globe.

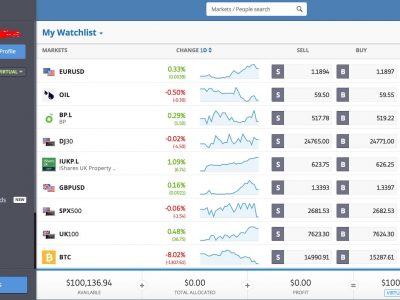

Clients can trade indices, FX, commodities and cryptos on their easy-to-use OpenBook platform. Users can also follow and copy expert traders, making it an ideal platform for beginners.

Read our independent eToro review and learn about the procs & cons of trading with this broker.

What Are The Advantages Of Social Trading With eToro?

Copy expert traders

Copy expert traders

eToro is a social trading network which means you gain access to their CopyTrader technology. This allows you to follow successful traders and copy their trades! Their platform allows anyone to become a follower or a leader (expert trader). Leaders will need to have their trading activity verified to prove they are indeed expert traders.

400:1 leverage

400:1 leverage

eToro are extremely generous when it comes to leverage. Higher leverage, whilst risky, means you need to deposit less money onto your account in order to trade.

Accessibility

Accessibility

It doesn’t matter if you’re a vastly experienced trader or a beginner, eToro is available to all. Social trading with eToro gives newbies the opportunity to create a passive revenue stream without any previous trading knowledge by following/ copying their leading traders.

They’re an STP broker

They’re an STP broker

eToro uses the Straight-Through-Processing (STP) broker model which means they operate a no-dealing desk operation. Thus, all client trades are sent direct to their liquidity providers for trade execution, without any dealing desk intervention/ manipulation. This will ensure all trades are executed quickly and the chance for slippages is greatly reduced.

Excellent trading tools

Excellent trading tools

eToro have an extensive range of trading tools. These are constantly developed to help all trader’s become as successful as possible. They have their CopyTrader system, CopyPortfolios and their Popular Investor Program. All three have helped contribute to making eToro the largest social trading network in the world.

Which Financial Instruments Can You Trade With eToro?

eToro offer thousands of tradeable financial assets, including;

- Stocks: choose from over 900 stocks from all around the world – UK, the US, Europe and Japan to name a few.

- FX: trade over 45 currency pairs, including all the major, minor and many exotic pairs too

- Indices: gain access all of the globe’s major indices, including the Australia 200, Wall St 30, the Nikkei, the FTSE 100 and many more.

- Commodities: trade all the major commodity markets like Oil, Gold, Silver, Copper, Natural Gas and Platinum.

- Cryptocurrencies: eToro clients can trade all the major crypto’s, including Bitcoin, Ethereum, Ripple, Litecoin and many more.

- ETFs: eToro offer a range of ETF markets, including Proshares Ultra S&P 500 (SSO), SPDR Gold (GLD) and Emerging Markets Index (EEM).

eToro Review – Other Important Features

Regulation

In Australia, products and services are provided by eToro AUS Capital Pty Ltd, who hold an AFSL (Australian Financial Services Licence) 491139, issued by ASIC and regulated under the Corporations Act.

Customer support

Their customer service team is available 24/5 across multiple languages, so there’s always professional help on standby if you need it.

Multiple deposit methods

You can deposit by: wire transfer, Visa, bank transfer, MasterCard, PayPal, Yandex, NETELLER, Webmoney UK. Skrill, plus more.

eToro’s trading platform

Education – learn for free

eToro offers a wide-range of trading tools and courses, which will give you everything you need to become an educated trader. Their educational courses offer a simple entry point into the world of online trading.

Different service levels

If you become a premium trader/ investor, you will get access to your own personal account manager, a special deposit bonus, free access to the Trading Central platform, withdrawal priority, free market analysis, special promotions and more.

Live Newsfeed

Receive regular updates from other traders on their social trading newsfeed – view expert trade decisions & analysis, share knowledge with the eToro network etc.

eToro – Commission & Fees

eToro has a relatively simple trading cost structure. There are no trading fees per se. However, they charge you spread for each trade (spread = the difference between the bid and offer price). Spread is a standard industry charge, i.e. every broker will charge you spread. The spread charges that eToro apply are relatively high when you compare them to competitors.

Why eToro Might Not Be For You…

Wide spreads

Wide spreads

eToro are by no means the cheapest broker around. That is the price you pay when it comes to social trading. There are a lot more upfront costs for eToro and these need to be passed on via the spread cost. Only fair I suppose! TD365 offer much lower brokerage spreads.

Inactivity fee

Inactivity fee

If eToro deems your account to be “inactive”, you will be charged a USD $10 inactivity fee – per month.